Service quality and system quality rank second and third

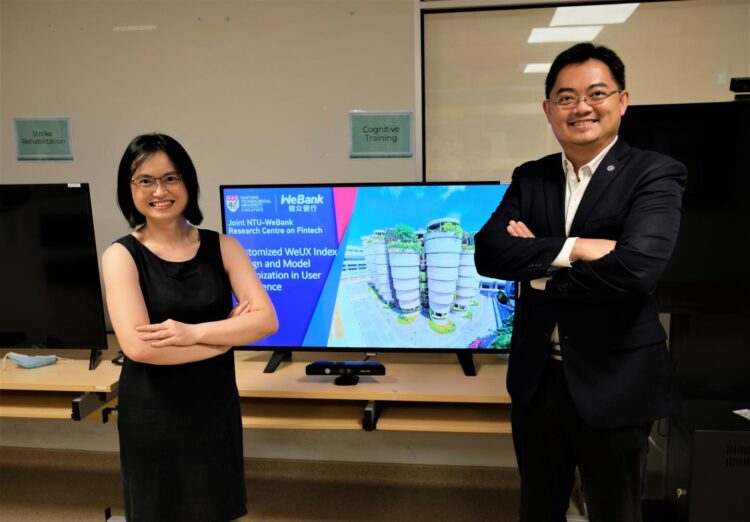

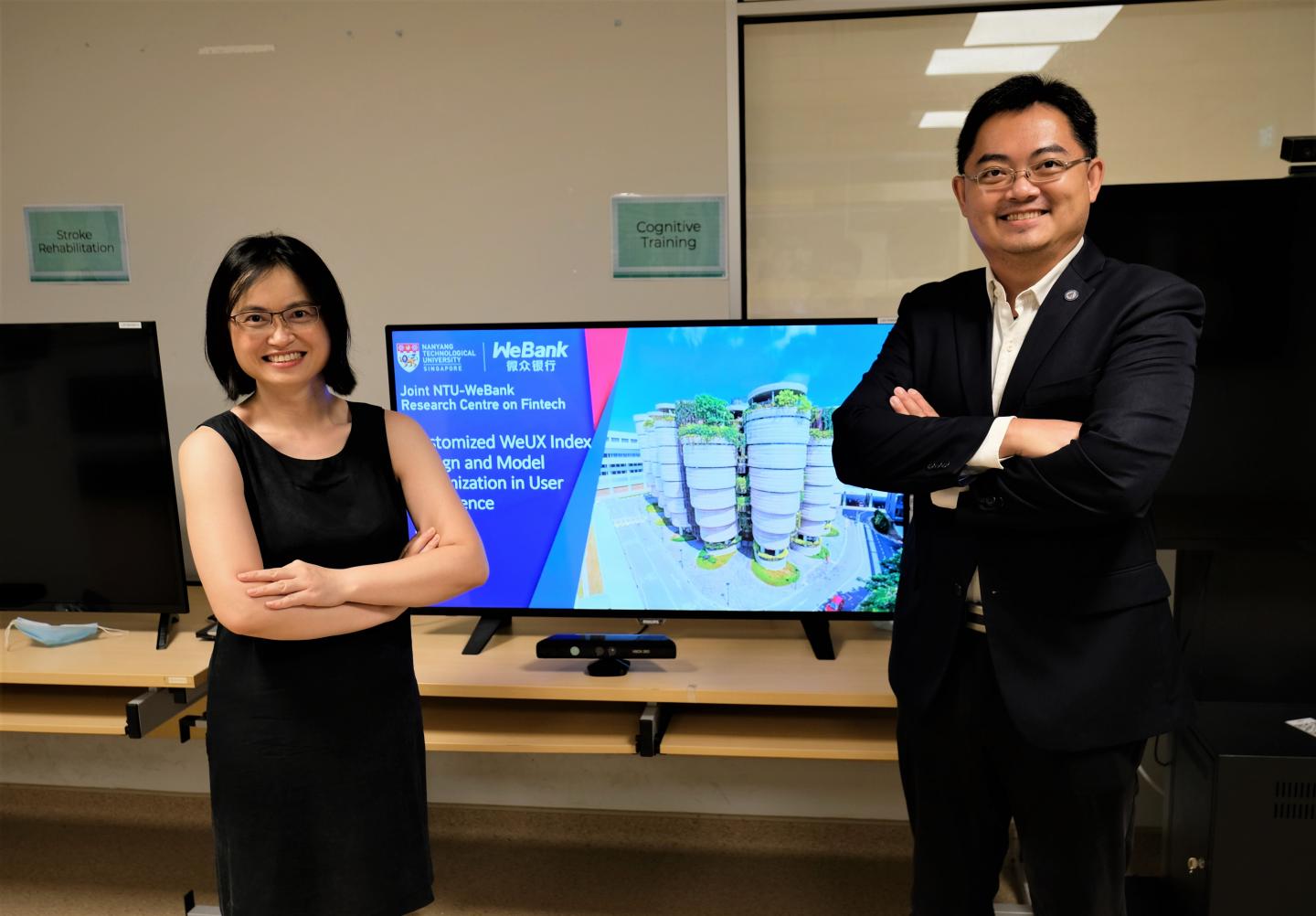

Credit: NTU Singapore

A study by a research team from Nanyang Technological University, Singapore (NTU Singapore) and China’s first digital-only bank WeBank has found that security, service quality and system quality are the most important factors for customers who use mobile banking.

Two in five respondents (40%) said that the security they felt while carrying out transactions on mobile applications was their most important consideration.

This was followed by the level of service quality (25%), which referred to whether the banking applications could fulfil users’ needs, such as carrying out transactions and easy access to credit card services.

System quality, which considers the performance of the application, including compatibility with different mobile phones and loading speeds, came in a close third (24%).

The results of the study were published in the Journal of Retailing and Consumer Services, an academic publication by Elsevier, last December.

The researchers said their study which ranked factors that are important in determining customer loyalty would be useful to financial institutions who are looking at improving their mobile banking applications.

Already widely used in China prior to COVID-19, mobile banking applications have seen a sharp rise in uptake throughout Asia during the pandemic, as the touchless payment systems provided by most mobile banking applications have gained traction.

The NTU-WeBank team obtained their results after surveying 224 mobile banking users of a large bank in China in 2019. Over three-quarters of the respondents (79%) were frequent users of mobile banking, meaning that they used it at least once a week.

The researchers said that although the study was conducted in China, the results are applicable to other countries where mobile banking has a high level of adoption, such as Singapore, Thailand, and Vietnam.

Associate Professor Xu Hong, from NTU’s School of Social Sciences who led the study, said: “It was already known that all these factors: security, service quality, system quality, and interface design had an impact on customers, and this study highlights implications for banks’ strategies for retaining their mobile banking users, as well as exploring how to capture new customers.”

Assistant Professor Yu Han, from NTU’s School of Computer Science and Engineering, who co-led the research, said: “Our study has implications for banks’ strategies for retaining their mobile banking users, as well as exploring how to capture new customers.”

Assoc Prof Xu and Asst Prof Yu are part of the team at the Joint NTU-WeBank Research Centre on Fintech which initiated this study. The joint centre was launched in early 2019 with the aim of developing new technologies to support Banking 4.0, where banking can be personalised and done anytime, anywhere.

Mr Joe Chen, Executive Vice President of WeBank, said: “The findings are relevant to other banks who are increasingly rolling out more digital solutions, which include payment, lending, and wealth management applications. As mobile banking worldwide is becoming increasingly accepted as replacement for branch-based banking in many countries, it is important for banks to know the factors that affect and influence customer loyalty. In this regard, the Joint NTU-WeBank Research Centre will continue to generate research outcomes and innovations for the benefit of the Fintech industry.”

NTU Senior Vice President (Research) Professor Lam Khin Yong, added: “The NTU-WeBank partnership is another example of the University’s strong links with the private sector. It also shows our strong support for industry collaborations that accelerates the translation of research into innovation and commercial adoption. This study also serves as a good example of interdisciplinary research involving faculty from the social sciences and computer science, as it solves a very important issue in today’s fintech industry.”

A multi-pronged approach to build customer loyalty

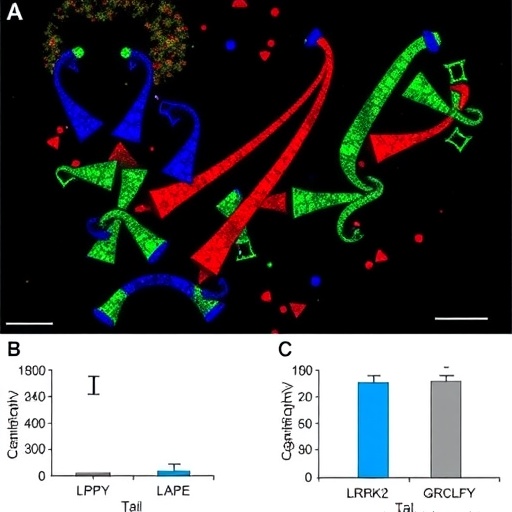

The team’s analysis of the results also showed that a mobile application’s interface design had a strong and positive impact on respondents’ evaluation of system and service quality.

This is despite it scoring relatively low compared to other factors surveyed in the study. For example, the team found that respondents tended to associate good interface design, such as smooth transitions between pages, with optimal system quality and high security.

The findings also outlined a larger correlation between several factors that were surveyed. For example, service and system quality and interface design were found to be important in sparking user loyalty, which the researchers defined as “the intention to continuously use the mobile banking product and recommend it to others.”

After analysing the survey results, the team advised that mobile banking operators should focus on providing multi-level security features to increase the users’ sense of security when using the applications.

Such features might include pop-up messages that alert users to the potential risks that could occur when using mobile banking services, as well as a well-documented policy statement from the financial institution.

Besides providing users assurance of their security while using the applications, Assoc Prof Xu added: “The level of service quality, which encompasses factors such as the levels of reliability, responsiveness, and empathy from bank staff, could enhance users’ satisfaction and increase their usage of mobile banking services.”

“By providing a stable and secure mobile banking system that boasts fast responses and efficient service, banks can encourage customers to continue using their mobile banking application, while ultimately strengthening user loyalty. The results can also help improve their overall mobile banking strategy and cater the functions of their apps to the needs of different age groups.”

Next steps: overseas studies

To further their research on loyalty intention in mobile banking, the NTU-WeBank team is looking to conduct studies in other countries and regions to identify other determinants that could affect customer loyalty.

Assoc Prof Xu said the team will continue to leverage the computing platform which it has developed to collect and analyse user experience data for future studies.

“We believe the large-scale immersive studies we will conduct using our computing platform powered by social computing and social media technologies will be able to help banks gain more insights into customers’ intentions,” said Assoc Prof Xu.

###

Media Contact

Joseph Gan

[email protected]

Original Source

http://news.

Related Journal Article

http://dx.