Biotech companies completing IPOs continue to initiate new product development, but 78% were conventional small molecule drugs, not biologicals

Credit: Center for Integration of Science and Industry, Bentley University

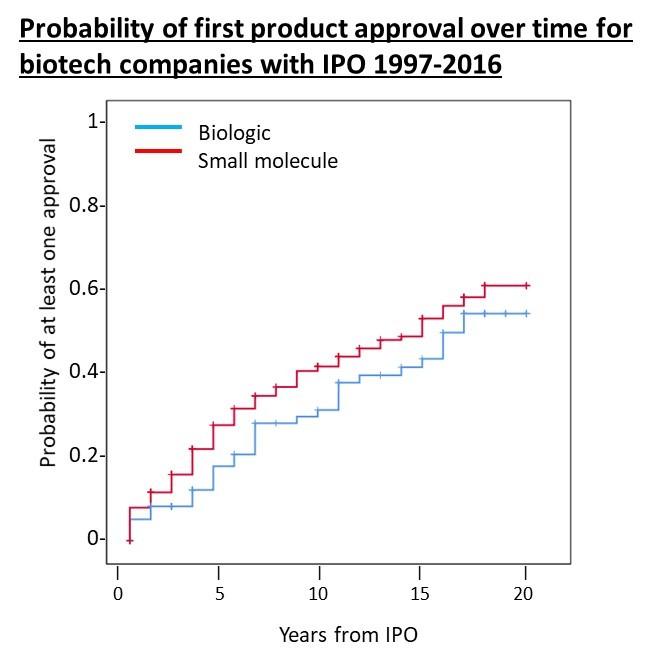

A large scale study from Bentley University of the biotechnology companies that completed Initial Public Offerings from 1997-2016 estimates that 78% of these companies are associated with products that reach phase 3 trials and 52% are associated with new product approvals. The article, titled “Late-stage product development and approvals by biotechnology companies after IPO, 1997-2016,” shows that these emerging, public biotechnology companies continue to have a role in initiating new product development, but are no longer distinctively focused on novel, biological products.

The new report from the Center for Integration of Science and Industry at Bentley University, published in Clinical Therapeutics, studied the 319 biotechnology companies focused on new drug development that completed Initial Public Offerings (IPOs) from 1997-2016. These companies contributed to development of 367 products that progressed to phase 3 and 144 new drug approvals through 2016, including 78 New Molecular Entities (NMEs). Key point of the study include:

- For 70% of the approved products, development was initiated by the biotech company;

- 77% were developed with corporate partners and 87% were ultimately launched by a pharmaceutical partner or after an acquisition;

- Seven products achieved annual sales of more than $1 billion during the study period;

- Small molecule drugs, rather than traditional biological products (proteins, cells) comprised 75% of products reaching phase 3 and 78% of approvals.

- Reformulations of existing products represented 36% of phase 3 products and 46% of approvals.

- These biotech companies contributed to 16% of all New Molecular Entities approved 1997-2016 and 28% of biological approvals.

“We see that over two decades, the majority of newly public biotechnology companies are able to successfully initiate development of products that progress to late stage development or approval, most of which are ultimately brought to market by established pharmaceutical firms.” ” said Dr. Fred Ledley, Director of the Center for Integration of Science and Industry. “Our study also shows that the product portfolio of biotech companies is no longer distinctively focused on novel biological products or methods, but encompasses a wide range of small molecules and reformulations.”

This study is one part of a large survey of the finances and late-stage product portfolios of companies with IPOs from 1997-2016, which show that, by the end of 2016, these companies had both created ~$100 billion in shareholder value and spawned 144 new products. While very few of these companies matured into fully integrated pharmaceutical companies, the long term economic performance of these biotech companies, in terms of market capitalization, shareholder value, fraction of companies acquired, and fraction of companies trading or sold above their IPO value, is similar to that of non-biotech companies with concurrent IPOs. Together these studies suggest that the risk of investing in public biotechnology companies is, in part, mitigated by this diversification into technologies with shorter times from IPO to approval and higher probabilities of success.

###

This study was authored by Dr. Laura M. McNamee, Dr. Ekaterina G. Cleary, Sunyi Zhang, and Usama Salim along with Dr. Ledley. Ms. Zhang was a graduate researcher, and Mr. Salim an undergraduate researcher, at Bentley University. This work was supported by a grant from the National Biomedical Research Foundation.

THE CENTER FOR INTEGRATION OF SCIENCE AND INDUSTRY at Bentley University focuses on understanding and accelerating the translation of scientific discoveries to create public value. The Center is an environment for thought leadership and interdisciplinary scholarship spanning basic science, data analytics, business and public policy. For more information, visit wwwbentley.edu/sciindustry and follow us on Twitter @sciindustry.

Bentley University is more than just one of the nation’s top business schools. It is a lifelong-learning community that creates successful leaders who make business a force for positive change. With a combination of business and the arts and sciences and a flexible, personalized approach to education, Bentley provides students with critical thinking and practical skills that prepare them to lead successful, rewarding careers. Founded in 1917, the university enrolls 4,200 undergraduate and 1,000 graduate and PhD students and is set on 163 acres in Waltham, Massachusetts, 10 miles west of Boston. For more information, visit bentley.edu.

Follow us on Twitter @BentleyU #BentleyUResearch.

For news media only:

Corresponding author: Dr. Fred D. Ledley, Director, Center for Integration of Science and Industry, Bentley University, Waltham, MA. Tel: 781.891.2046; email: [email protected]

Media Contact

Michelle Linn

[email protected]

Original Source

https:/

Related Journal Article

http://dx.