The illegal wildlife trade (IWT) is a fast-growing ‘financial portfolio’ within the larger illegal, violent, parallel transnational global economy. As such, it creates state-level security and development risks, especially in source countries.

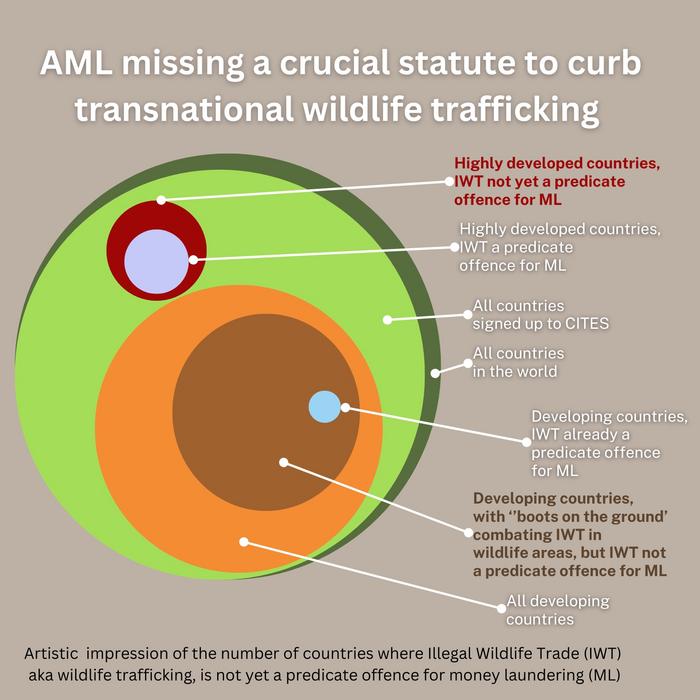

Credit: Graphic by Therese van Wyk, University of Johannesburg.

The illegal wildlife trade (IWT) is a fast-growing ‘financial portfolio’ within the larger illegal, violent, parallel transnational global economy. As such, it creates state-level security and development risks, especially in source countries.

IWT is also known as wildlife trafficking, which includes the illicit trade of animals and plants, and derivative products such as pangolin scales, rhino horn, elephant ivory, lion and tiger bones, and leopard pelts.

But many highly developed countries signed up to CITES, are yet to implement a crucial legal instrument required to prosecute IWT and the associated financial flows more effectively, says Dr Cayle Lupton from the University of Johannesburg (UJ).

The same countries also happen to be signatories of the United Nations Convention against Transnational Organized Crime (UNTOC).

In addition, he says IWT law enforcement can be significantly boosted by private companies – if banks and other financial institutions start fast and efficient sharing of Anti-Money Laundering (AML) and IWT intelligence within countries and across borders.

Lupton has published the study ‘Illegal wildlife trade: the critical role of the banking sector in combating money laundering’ in the Journal of Money Laundering Control.

Lupton is a Senior Lecturer in the Department of Procedural Law, within the Faculty of Law. He is a certified anti-money laundering specialist and an attorney of the High Court of South Africa.

IWT the lesser-known precursor to money laundering

Developed countries are having mixed results in curbing transnational money laundering (ML) in general and IWT in particular, says Lupton. There are reasons for that.

“International IWT operations are difficult to detect and disrupt. Investigations are complicated by the cross-border movement of wildlife or derivatives,” says Lupton.

“Also, IWT operators use complex money laundering techniques involving large amounts of cash, and front and shell companies.

“Dealing with IWT as a national issue may not enable the identification and disruption of international trafficking networks. Cooperation at the local, regional and especially international level is imperative in this regard,” adds Lupton.

Countries making AML progress

Some countries are making significant progress in their financial systems though, says Lupton, and a good example is the Monetary Authority of Singapore (MAS).

The MAS project starts with the ‘big three’ multinational banks based in Singapore and another three multinational banks. It’s called “Collaborative Sharing of Money Laundering/Terrorism Financing (ML/TF) Information & Cases” or COSMIC for short.

Also, he says the UK and Australia are examples of countries gaining major ground in sufficiently meeting most of the recommendations from the global Financial Action Task Force to combat money laundering and other illicit financial flows.

Exploiting vulernabilities

But IWT operators exploit vulnerabilities in developed countries.

As an example, says Lupton, a surprising number of highly developed countries in Western Europe, who are signatories to CITES, still haven’t created laws to make IWT a predicate offense for money laundering.

The majority of developing countries don’t have such laws either. Also where there are ‘boots on the ground’ physically combating IWT in areas with endangered species, he adds.

Predicate offence, owners of companies

Wildlife trafficking can be made a predicate offence for money laundering in at least two different ways, says Lupton.

“Firstly, laws may refer explicitly to wildlife trafficking as a predicate offence. This is the case in the USA, where the Eliminate, Neutralize and Disrupt Wildlife Trafficking Act (END Act) allows USA prosecutors to treat wildlife trafficking as a predicate offense for money laundering.

“Secondly, AML laws may be formulated in such a way that an inference can be drawn to wildlife trafficking as a predicate offence. In these instances, provisions are usually formulated widely so that all criminal offences are regarded as predicated offences.

“In South Africa, for example, ‘money laundering’ is defined with reference to ‘unlawful activities’ which includes illegal wildlife trafficking,” he says.

In addition, FATF recommendation 24 requires countries to ensure that competent authorities have access to adequate, accurate and up-to-date information on the true owners of companies. This is required to combat the use of anonymous shell companies and other businesses to hide money laundering.

Beneficial Ownership Registries are implemented by countries to meet this recommendation.

Taking IWT seriously as trafficking

Despite wildlife trafficking growing into one of the biggest crime industries in the world, it is not prioritised in the same way as drug or people trafficking by governments and financial institutions, says Lupton.

“There is still relatively little known about the financial flows and, more specifically, the money laundering practices pertaining to IWT. Many countries still don’t treat IWT as a serious crime, especially countries that are not regarded as source or transit destinations”, he says.

Promulgating IWT as a predicate offence for money laundering, combined with legislative penalties, will increase costs for banks and other financial institutions. Particularly for their compliance programmes for AML (anti-money laundering), customer due diligence (CDD), and KYC (know your customer), if allocated realistic resources. For banks, a robust compliance programme is the cornerstone to adequately dealing with the financial flows linked to wildlife trafficking.

Says Lupton: “As IWT risks are unique, they require special resources in their mitigation, including focused training, case studies and risk indicators specific to IWT.”

First step – IWT as predicate offence

As a first step, many countries need to promulgate laws so that illegal wildlife trade becomes a predicate offence for money laundering, says Lupton.

“Banks, investment companies, real estate companies and other privately owned organisations have to start monitoring their financial systems for signs of money laundering specific to IWT,” he adds, “otherwise they may have to pay statutory penalties for non-compliance. In general, penalties drive compliance.”

“This additional AML monitoring is required, even if endangered animals are slaughtered in another country, or the derivative products will be sold in another country.”

Step two – Banks sharing intelligence

The next step is for banks to share information quickly and efficiently about transactions possibly linked to IWT.

Combining the two steps create new options to prosecute IWT, he says.

“In its 2020 report Money laundering and the illegal wildlife trade, the FATF endorses a private-to-private model of information sharing. They identify indicators to look out for, such as large cash deposits by government officials working in wildlife protection agencies, border control or customs and revenue officials.

“In my view, banks are particularly well positioned to enable cooperation between themselves in the investigation of transnational IWT financial flows.

“Banks can leverage their existing domestic, regional and international networks. If they share financial intelligence quickly and effectively, that can support the investigations of law enforcement agencies.

“Such shared information can also assist in the freezing and confiscation of laundered funds or property connected to IWT,” says Lupton.

Overall, curbing IWT not only protects endangered species and the global financial system but can also boost sustainable local development and legal job creation. Future sources of medicines, and cultural practices which regard endangered animals as sacred can also be preserved, he concludes.

ENDS

###

Notes to Editors

For more information, or to interview Dr Lupton please contact:

Ms Therese van Wyk, Research Media Liaison, University of Johannesburg, +27 71 139 8407 (Mobile and Whatsapp), [email protected].

Media Pack

Additional background on

- How wildlife trafficking relates to other forms of global trafficking, especially in South Africa

- Five reasons curbing IWT benefits society

- URL links to the global UN / FATF reports, projects and other background information of interest.

is available in an extended version of the news release in Google Drive at:

https://drive.google.com/drive/folders/1K6E12zRsMyflL0Ll9NzUE3Fheye5OhT5?usp=sharing

Without logging in or registration on a computer.

Graphic

The graphic is available in the Google Drive media pack in more formats, including transparent backgrounds which are easier to adapt for a house style.

Journal

Journal of Money Laundering Control

DOI

10.1108/JMLC-06-2023-0105

Method of Research

Literature review

Subject of Research

Not applicable

Article Title

Illegal wildlife trade: the critical role of the banking sector in combating money laundering

Article Publication Date

31-Aug-2023

COI Statement

The corresponding author states that there is no conflict of interest.