Credit: SUTD

Blockchain technology has been considered as the most revolutionizing invention since the Internet. Due to its immutable nature and the associated security and privacy benefits, it has widely attracted the attention of banks, governments, techno-corporations, as well as venture capitalists.

To participate in the blockchain consensus mechanisms, prospective network nodes – also called miners – need to provide proof of some costly resource. This resource may be computational power in protocols with Proof of Work mechanisms or coins of the native cryptocurrency in Proof of Stake mechanisms.

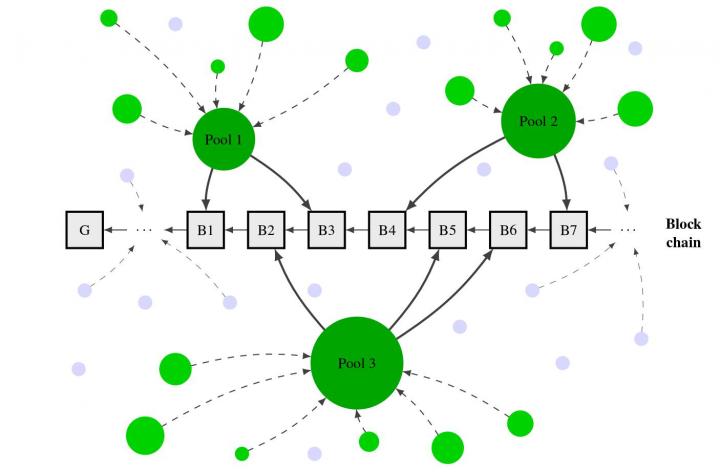

An integral assumption in the security philosophy of public blockchains is that the network of mining nodes remains sufficiently decentralized and distributed. In the extreme case, sufficiently means that no single entity holds 50% or more of the resources but in practice much more decentralization may be desired to safeguard the underlying protocol.

However, currently available data demonstrates that mining resources are much more centralized than originally thought, leading essentially to a reinvention of our current banking system instead of the intended decentralized digital currency of the future, see Figure 1.

Assistant Professor Georgios Piliouras of Singapore University of Technology and Design and Stefanos Leonardos, postdoctoral research fellow at the iTrust Centre for Research in Cyber Security in collaboration with Nikos Leonardos from the National and Kapodistrian University of Athens developed a novel approach to untangle the centralization phenomena in blockchain mining. They employed the rich economic theory of Oceanic Games, originally devised by the 2012 Nobel Laureate in Economics, Loyd S. Shapley.

The application of this theory in the currently evolving blockchain ecosystem unveiled incentives both for active and for newly entering miners to merge and act as single entities. These observations provide an alternative justification of the observed centralization and concentration of power in the mining process of the major cryptocurrencies. Contrary to common perceptions, they amount to the existence of a negative feedback loop in terms of decentralization as a core ingredient in public blockchain philosophy and reveal the need for further research in this direction.

For this work, the research team was accredited with the Best Paper Award in the 1st International Conference on Mathematical Research for Blockchain Economy.

###

Media Contact

Melissa Koh

[email protected]