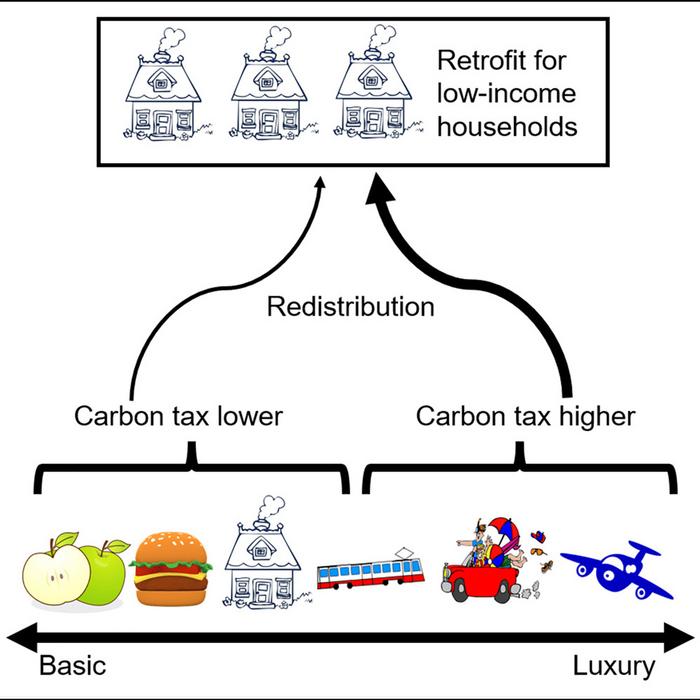

Not all carbon emissions are made for the same reason—they range from more essential purposes like heating a home to nonessential “luxury” activities like leisure travel. However, proposals for the implementations of carbon taxes tend to apply to all emissions at an equal rate. This can give rise to and exacerbate inequalities. A new analysis published on July 11 in the journal One Earth suggests taxing luxury carbon emissions at a higher rate instead; if all 88 countries analyzed in this study adopted the luxury-focused policy, this would achieve 75% of the emissions reduction needed to reach the Paris Agreement’s goal of limiting climate change to well below 2°C by 2050.

Credit: One Earth / Oswald et al.

Not all carbon emissions are made for the same reason—they range from more essential purposes like heating a home to nonessential “luxury” activities like leisure travel. However, proposals for the implementations of carbon taxes tend to apply to all emissions at an equal rate. This can give rise to and exacerbate inequalities. A new analysis published on July 11 in the journal One Earth suggests taxing luxury carbon emissions at a higher rate instead; if all 88 countries analyzed in this study adopted the luxury-focused policy, this would achieve 75% of the emissions reduction needed to reach the Paris Agreement’s goal of limiting climate change to well below 2°C by 2050.

“There is an injustice in terms of who uses energy, or carbon, for basic or luxury purposes, but it hasn’t been translated into explicit policy yet,” says Yannick Oswald (@yl_oswald), an economist at the University of Leeds. “In this study, we test policies derived from this knowledge for the first time.”

Several countries—such as Canada and Mexico—have active carbon pricing policies. These policies either price all emissions at an equal rate or target one type of emission, such as heat or fuel. However, past research has shown that, in high-income countries, these policies tend to affect low-income households the most while failing to have a large impact on emissions. This might be because resources such as heat or fuel make up a greater portion of low-income spending and are difficult to do without.

To test the impact of a tax program that distinguishes between carbon emissions from basic or luxury activities, the researchers built a model based on household carbon footprints from 88 different countries. For each country, they designed a tax rate for different types of purchases, ensuring activities that make up a greater proportion of low-income spending would be taxed less relative to activities that make up a greater proportion of high-income spending. In the US, for example, vacation travel would be taxed at a higher rate than heating.

They used this model to test the outcome of either their luxury carbon tax rates or a uniform carbon tax rate. Under a uniform tax rate, 37% of global carbon tax revenue would come from luxury purchases. This increases to 52% under a luxury-focused tax program.

Not only was the luxury tax “fairer” based on household income – affecting low-income households less and high-income households more – it also was slightly better at reducing yearly household emissions in the very short-term. The researchers note that this might be because it is more feasible to forgo luxury purchases than an essential purchase if the price increases.

While the luxury tax proved fairer in all countries studied, the researchers found that, in low-income countries, a uniform tax could also be fair. In South Africa, for example, low-income households already spend much less on fuel or heating than high-income households. Thus, a uniform carbon tax is already targeting high-income groups by design. In contrast, the luxury carbon tax is most beneficial in terms of fairness when applied to high-income countries. This tax can better account for flexible, nonessential purchases in countries like the United States, where it is difficult to avoid carbon-emitting activities like driving a car in a low-income lifestyle.

While this type of policy could make significant progress towards reducing global emissions, the researchers also note that this goal might be difficult to achieve in practice. Few countries have a carbon tax scheme that is currently this rigorous. Luxury-focused carbon taxation also targets high-income groups, which may be the most equipped to lobby against such a policy going into effect.

“Global support by the public for fair climate policies is high, and it is likely that luxury-focused carbon taxes are similarly popular,” says Oswald. “Despite the model’s limitations, the big takeaway is this: when designing climate policies, it is possible to pay attention to the different nature of consumption purposes, and this would improve the fairness of climate policy almost by default.”

###

This work was supported by the Leverhulme Trust, the UK Research and Innovation Energy Programme, and the Engineering and Physical Sciences Research Council. The authors declare no competing interests.

One Earth, Oswald et al. “Luxury-focused carbon taxation improves fairness of climate policy” https://www.cell.com/one-earth/fulltext/S2590-3322(23)00261-0

One Earth (@OneEarth_CP), published by Cell Press, is a monthly journal that features papers from the fields of natural, social, and applied sciences. One Earth is the home for high-quality research that seeks to understand and address today’s environmental Grand Challenges, publishing across the spectrum of environmental change and sustainability science. A sister journal to Cell, Chem, and Joule, One Earth aspires to break down barriers between disciplines and stimulate the cross-pollination of ideas with a platform that unites communities, fosters dialogue, and encourages transformative research. Visit http://www.cell.com/one-earth. To receive Cell Press media alerts, contact [email protected].

Journal

One Earth

DOI

10.1016/j.oneear.2023.05.027

Method of Research

Computational simulation/modeling

Subject of Research

Not applicable

Article Title

Luxury-focused carbon taxation improves fairness of climate policy

Article Publication Date

11-Jul-2023