Title: The Hidden Burden of Healthcare Costs on American Households

In contemporary America, the escalating costs associated with healthcare are increasingly causing significant financial distress among households, even those with insurance coverage. According to a recent survey conducted by the organizations West Health and Gallup, a staggering 31 million Americans, representing 12% of the adult population, found themselves needing to borrow roughly $74 billion in the previous year to manage their healthcare expenses. This financial strain is particularly pronounced despite the fact that many of these individuals possess some form of health insurance, underscoring the inadequacies of current healthcare financing structures.

The survey highlights alarming disparities in the borrowing landscape. Among respondents aged 49 and younger, nearly 20% reported having to borrow money to meet their medical expenses, a stark contrast to the 9% of those aged 50 to 64 who faced similar challenges. This trend is notably more acute among women in the 50 to 64 age bracket, who were found to be twice as likely as their male counterparts to incur medical debt, with figures reflecting 12% of women versus 6% of men. Even more concerning, only 2% of individuals over the age of 65, generally eligible for Medicare, reported needing to borrow.

Tim Lash, President of the West Health Policy Center, emphasized the plight of many Americans navigating the complexities of healthcare financing. He commented on the dire need for systemic policy reforms, stating that an exorbitantly priced healthcare system forcing citizens into debt signifies an urgent call for transformation. Without meaningful change, the issue of medical debt risk is poised to worsen, affecting more families and individuals already struggling with financial constraints.

Racial and economic demographics illustrate that borrowing patterns vary significantly across different groups. The survey found that 23% of Black adults and 16% of Hispanic adults reported borrowing money to cover medical costs, compared to just 9% of White adults. The most pronounced disparities appeared among adults under 50, where 29% of Black adults aged 18-49 and 19% of Hispanic adults reported needing to borrow, in comparison to 14% of their White peers in the same age cohort. Moreover, households with children under 18 exhibited double the borrowing rate compared to those without dependents, highlighting how family dynamics can exacerbate financial vulnerability.

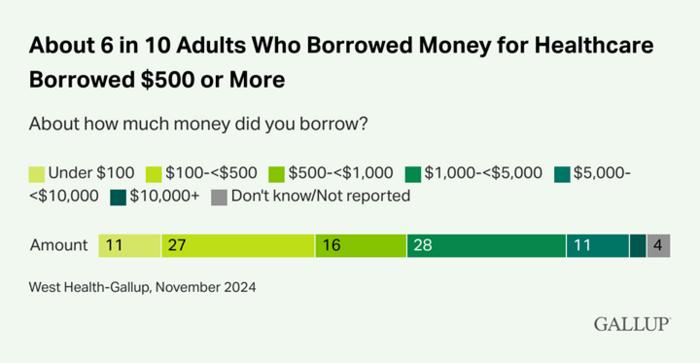

Analyzing the overall borrowing statistics, the report reveals a staggering collective borrowing of approximately $74 billion, with 58% of borrowers having to secure loans in excess of $500. The data further illustrates that 41% of those surveyed borrowed $1,000 or more, while a notable 14% found themselves in the dire situation of borrowing $5,000 or more, indicating severe financial distress in accessing necessary healthcare services.

When it comes to concern over incurring medical debt, the findings reveal a widespread anxiety that transcends demographics. A significant 58% of Americans expressed a level of concern that a major health event could result in debt, with 28% categorizing themselves as “very concerned.” This sentiment is particularly keen among lower-income households; more than 60% of families earning less than $120,000 reported worries about potential healthcare bankruptcy, and even among those earning upwards of $180,000, 40% voiced similar concerns.

Even within the cohort of Medicare-eligible individuals, over half (52%) of seniors reported being at least somewhat worried about incurring medical debt in the event of a serious health issue. This anxiety was also reflected among minority groups, with 62% of Black adults, 63% of Hispanic adults, and 62% of women highlighting similar fears. Alarmingly, just 14% of respondents stated they were not concerned at all, indicating an almost universal recognition of the financial implications of healthcare access and affordability.

Dan Witters, the director of wellbeing research at Gallup, remarked on the precarious nature of American healthcare costs, suggesting that financial insecurity linked to healthcare is an issue that affects a broad spectrum of the population, cutting across demographic lines. The findings serve as a significant indicator of the urgent need for effective solutions aimed at enhancing healthcare affordability and accessibility, ultimately striving to alleviate the financial burden carried by millions of Americans.

As the healthcare landscape continues to evolve, the insights gained from this survey underscore the importance of addressing the core issues driving medical debt. The intricate relationship between healthcare costs and financial wellbeing calls for a multifaceted approach, focusing not only on policy reform but also on systemic changes within healthcare institutions that prioritize patient welfare over profit margins.

The West Health-Gallup Survey, which gathered responses from a diverse and nationally representative sample of 3,583 adults aged 18 and older, provides invaluable data for understanding the breadth of this issue. Conducted online between November 11 and November 18, 2024, the survey results carry a margin of sampling error of ±2.1 percentage points at a 95% confidence level, granting the findings credible weight as we navigate the complexities of healthcare finance in America.

The persistence of high healthcare costs, coupled with the emotional and psychological toll of medical debt, illuminates a critical need for advocacy and reform. The emphasis on creating affordable healthcare options is paramount to ensure that all citizens, regardless of their financial circumstances, have access to the medical services they need without the fear of life-altering debt.

As we consider the future trajectory of healthcare costs in the United States, it is clear that the challenges facing American families are vast. Policymakers, healthcare providers, and advocacy groups must unite in their efforts to assemble actionable strategies designed not only to diminish current debt burdens but also to foster a healthcare system characterized by transparency, affordability, and equity.

In conclusion, the alarming data from the West Health and Gallup survey starkly highlights the dire financial landscape many Americans navigate when searching for healthcare solutions. The focus must now shift towards collaborative efforts aimed at tackling these obstacles head-on, striving for a system that upholds the dignity and health of every individual without placing unbearable financial pressures on households across the nation.

Subject of Research: The impact of healthcare costs on American households and borrowing trends.

Article Title: The Hidden Burden of Healthcare Costs on American Households

News Publication Date: March 5, 2025

Web References: West Health, Gallup

References: West Health-Gallup Survey, conducted Nov. 11-18, 2024.

Image Credits: West Health-Gallup

Keywords: healthcare costs, medical debt, financial distress, healthcare access, borrowing trends, socioeconomic disparities, American households.

Tags: American households and medical debtborrowing for healthcare expensesdisparities in medical debt by agefinancial strain of medical expenseshealthcare affordability issueshealthcare costs and insurancehealthcare debt in Americahealthcare financing inadequaciesimpact of healthcare costs on householdsrising healthcare costs in the USsurvey on healthcare borrowing trendswomen and healthcare financial burden