A timer option is a financial instrument, launched by Société Générale Corporate and Investment Banking in 2007, that allows buyers to specify the level of volatility and allows them to exercise their option at a random maturity time. In other words, the payoff of the timer option depends only on a random date determined by the time needed to realize a prescribed variance budget for the underlying asset. This is contrary to vanilla options, which are always exercised at a fixed, predetermined price within a given timeframe.

Credit: Ji-Hun Yoon from Pusan National University

A timer option is a financial instrument, launched by Société Générale Corporate and Investment Banking in 2007, that allows buyers to specify the level of volatility and allows them to exercise their option at a random maturity time. In other words, the payoff of the timer option depends only on a random date determined by the time needed to realize a prescribed variance budget for the underlying asset. This is contrary to vanilla options, which are always exercised at a fixed, predetermined price within a given timeframe.

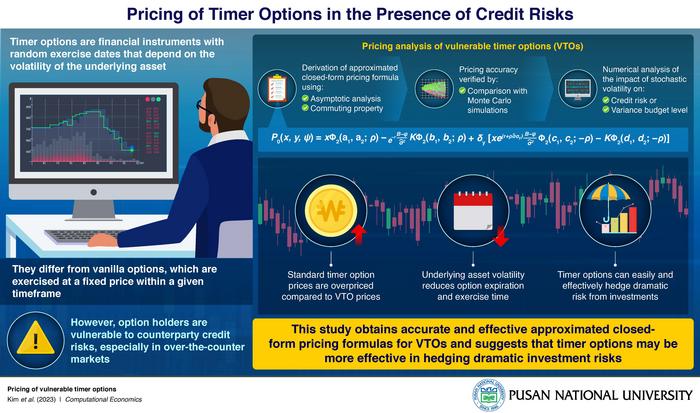

However, option as financial instruments are vulnerable to credit risks arising from the uncertainties regarding counterparties not upholding their contractual obligations, especially in over-the-counter markets. Global financial crises like the subprime mortgage crisis in the United States in 2007–2008, the Eurozone crisis in 2010, and more recently, COVID-19 pandemic and Russia–Ukraine conflict, have led to growing concerns about counterparty default risks among investors.

Against this backdrop, a team of researchers from Korea, led by Associate Professor Ji-Hun Yoon from the Department of Mathematics at Pusan National University, has recently investigated the pricing of vulnerable timer options (VTOs)—or options that are prone to such credit risks. Their work was made available online on 12th October 2023, published by Computational Economics.

“Motivated by the credit risk model proposed by Johnson and Stulz, we discuss the analytic pricing formulas of VTOs, where the cumulative realized variance of the underlying asset follows the stochastic volatility (SV),” says Dr. Yoon.

For this, the researchers first derived approximated closed-form formulas for VTOs using the singular perturbation method—a type of asymptotic analysis, and commuting property. Additionally, they analyzed the pricing accuracy of their analytic formulas and compared them with the solutions obtained from Monte Carlo simulations. The proposed pricing formulas for VTOs were found to be accurate and effective. Their accuracy increases as the mean-reverting parameter goes to zero.

Furthermore, the team numerically examined the effect of stochastic volatility on the credit risk or variance budget level. They found that the prices of standard timer option prices are overpriced, as compared to VTO prices in the case of European vanilla options. These results thus highlight that VTOs could be one of the most promising financial contracts for market participants.

Notably, the higher the volatility of the underlying asset, the time taken by the timer options to reach the expiration date is less and they get exercised faster. On the other hand, the lower the volatility, the time taken by the timer options to reach the expiration date is more, which ultimately delays the exercise time of the options. “Based on this situation, in the case of option holders who invest in the put option, timer options are exercised at an early stage compared with European vanilla options, when there are drastic changes in the volatility resulting from unpredictable risks, such as the global financial crisis and diverse natural disasters,” explains Dr. Yoon. Hence, timer options, and especially VTOs, can easily and effectively hedge the dramatic risk from investments.

The researchers speculate that the findings from this study may be applicable to diverse challenging volatility management problems or risk management strategies. Additionally, future studies can build upon these findings to shed light on the pricing of path-dependent timer options, such as barrier options and floating strike lookback options, ultimately enhancing the profitability for option holders.

Overall, this research can pave the way for broader adoption of VTOs, potentially making the financial market more secure and accessible to all!

***

Reference

DOI: https://doi.org/10.1007/s10614-023-10469-1

About the Institute

Pusan National University, located in Busan, South Korea, was founded in 1946 and is now the No. 1 national university of South Korea in research and educational competency. The multi-campus university also has other smaller campuses in Yangsan, Miryang, and Ami. The university prides itself on the principles of truth, freedom, and service, and has approximately 30,000 students, 1200 professors, and 750 faculty members. The university is composed of 14 colleges (schools) and one independent division, with 103 departments in all.

Website: https://www.pusan.ac.kr/eng/Main.do

About the author

Professor Ji-Hun Yoon is currently an Associate Professor at the Department of Mathematics at Pusan National University. His research group specializes in developing closed-form solutions for the various financial derivatives and options calibration, using data sourced from the financial markets. Dr. Yoon earned his Ph.D. from Yonsei University in 2013 and subsequently served as a postdoctoral fellow at Seoul National University. In 2015, he assumed the role of Assistant Professor in the Department of Mathematics at Pusan National University. Throughout his career, he has authored numerous research articles published in esteemed journals, showcasing his significant contributions to the field. To know more about his lab, visit here.

Journal

Computational Economics

DOI

10.1007/s10614-023-10469-1

Method of Research

Computational simulation/modeling

Subject of Research

Not applicable

Article Title

Pricing of vulnerable timer options

Article Publication Date

12-Oct-2023

COI Statement

The authors declare that they have no conflicts of interests.